The rising cost of living within the United Kingdom

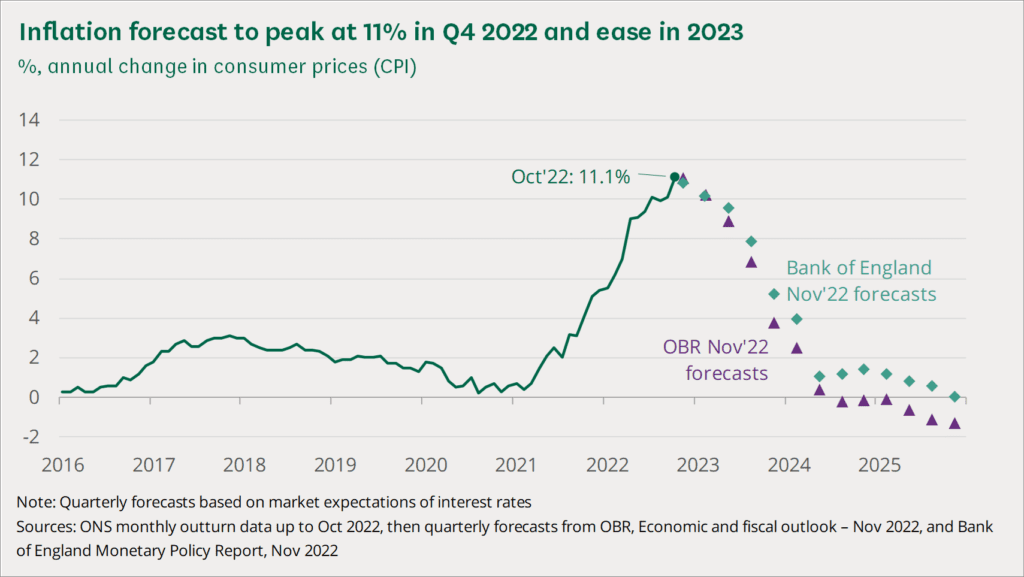

The cost of living is increasing at its fastest rate in 40 years, largely due to an unprecedented rise in the price of energy and consumer goods. According to the Office of National Statistics, consumer prices as measured by the Consumer Prices Index (CPI), were 11.1% higher in October 2022 than a year before.

From October 2021 to October 2022, domestic gas prices increased by 129% and domestic electricity prices by 66%. Gas prices increased to record levels after Russia launched its full-scale invasion of Ukraine and continued to rise during much of 2022 due to cuts in Russian supply. Electricity prices are linked to gas prices and have followed a similar trend.

However, the department forecasts that the rising rate of inflation will largely drop within the upcoming 2-3 years. Nevertheless, this does not mean that the prices will reduce but will not rise as quickly as it has been observed recently. Given this consolation, continuing uncertainty over global conditions, energy prices, and the government’s tax and spending plans make it hard to predict what the future holds.

Despite the rising cost of living, there are ways that business can adopt to support their employees within these unprecedented times.

Increasing salary and wages – a solution or a façade?

For employers to support employees through these difficult times, the obvious solution to ease financial worries would be to offer pay rises in line with, or above, inflation – but, to be realistic, for most employers this is neither possible nor feasible as many are still trying to find their feet again as we emerge from a global pandemic. This is because rising costs have adversely effected business operations through increased costs of raw materials, rentals, and other routine expenses. Which could lead to businesses make a little profit or no profit at all. Therefore, increasing wages, which is usually the largest expense for a business may not sound like a great idea to the employers.

The external perspective – the people and the government?

Where 82% of people in a BBC-commissioned survey of 4000 said that their wages should increase to match the rising price of goods and services; wage raise has become a public expectation within the United Kingdom. We are seeing regular strikes and protests over wage stagnation and inadequate raises.

Contrarily, the government argues that big pay rises could push inflation even higher as the burden of rising wages could fall on the consumer prices, which is what companies would eventually do. Mr Clarke, who is chief secretary to the Treasury, told the BBC that “unrealistic expectations around pay” could “intensify this endless inflation problem”.

What HR can do to support the employees in these unprecedented times?

Common people who make up majority of the workforce in the United Kingdom are the ones being burdened the most by the rising cost of living. What’s interesting is that these people are not even unemployed or struggling with work. They effectively perform their duties and fulfil their tasks by putting in a lot of hard work and dedication. However, due to the current crisis, they still tend to have worries by the end of the month.

Which means that in your workforce right now there are most probably people who are in debt; worried about how to pay their bills, in fuel poverty; reducing the number of washes they put on a week, unscrewing bulbs to save on electricity, relying on food banks or skipping meals all together.

Which all together can eventually lead to lower productivity and motivation at work. Therefore, this problem lies at the heart of what HR does. The following will cover a few strategies that HR could implement to share the burden and support the workforce.

- Re-evaluate the financial contributions from employees

Employers should re-structure as well as ease the provident fund or pension contributions from the employees. This money could instead be utilised towards increasing the take home pay. However, it is crucial that employers must take into notice the risks which might be there for the employees if pension schemes are withdrawal, and how to mitigate those.

- Encourage employee discounts and benefits scheme

Businesses can partner with consumer goods retailers and service providers to offer subsidised prices to their employees. These could include subsidised groceries, gym memberships, travel allowances etc. Additional benefits could include free breakfast/lunch options within the offices. It is important that the workforce is clearly communicated and encouraged to utilise these benefits.

- Allow remote/flexible working conditions

Remote working could have a significant impact on employee spending as not on the transportation costs are mitigated, but extra expenses relating to food, childcare, pet care etc. could be reduced. In fact, employees can apply for work from home allowance with the government to get tax rebate. This could also allow many workers to relocate to less expensive areas.

- Financial well-being initiatives and education

Giving financial education to the workforce can have an impact on mitigating the crisis. This could be done in several cost-effective ways including seminars, webinars or some form of financial guidance on a one-to-one basis. Additionally, companies can introduce initiatives that allow early access to employee salaries. Employees could retrieve a partial amount from their salary before the end of the month, allowing them to avoid debt/loans, and manage their finances more optimally.

- Creating hardship/crisis funds

The organisations could create a pool as rainy-day funds to help employees with one off payment to cater their needs during any hardship. Highly paid officials could be encouraged to add up into the pool to help their colleagues, anonymously. This would not only help the colleagues in need but boost the overall morale of the workforce as it will allow them to feel a sense of safety. Such funds could allow interest-free loan initiatives as well; the workforce can acquire a sum and return on monthly basis from their salary.

- Promotion of mental and emotional well-being

Financial anxiety could have a significant impact on workplace productivity and effectiveness. Therefore, it is important that organisations cater to the mental wellbeing of their employees through regular counselling sessions and educative meetings. Despite the existence of financial problems, working on mental health and emotional wellbeing could ease up an employee’s life. This will also the workforce to be more connected to the organisation and feel supported.

The list of strategies that could be adopted by HR can go forever, depending on the industry, geography, and circumstances. The above are the highlights of what can be implemented generally within all industries in a swift manner.